How Manufacturers Can Advance Data Maturity and Uncover the “Why”

Industrial manufacturers are collecting more data than ever, but without cross-functional visibility and the ability to analyze intelligently, most insights remain reactive.

Data maturity in industrial manufacturing is one of the greatest barriers to achieving more substantial efficiency both upstream and downstream. An immature data foundation is indicative of who will trail in AI adoption and automation or lose margin to poorly optimized processes and portfolio decisions.

While leadership teams have plenty of data at their fingertips, their ability to act on that data is reactive, rather than proactive. And fragmented reporting means that manufacturers can only answer “what” happened but still struggle with the “why”. What manufacturers will need to accelerate maturity is the ability to retrieve, validate, and act on information in a centralized way.

Data reporting is going digital, but not cross-functional

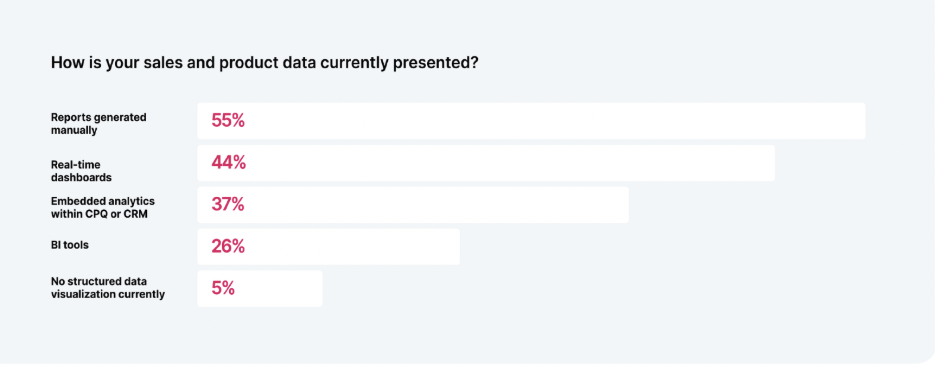

Sales, engineering, and production teams understand the pain of making IT requests to retrieve specific data points, or waiting over a week to get the right report and share it with the right teams. In fact, 55 percent of sales and product reports are still generated manually, according to the Tacton 2025 State of Manufacturing report.

Fortunately, this tide is changing as more manufacturers invest in dashboard tools, integrate systems with BI tools, or use embedded analytics within their CRM or ERP. The Manufacturing Leadership Council (MLC), in conjunction with Tacton, found that surveyed manufacturers may be more digitized in their reporting than previously thought.

In the MLC and Tacton webinar, “State of Manufacturing: How Leaders Are Creating a Customer-Centric Smart Factory in 2025,” 31 percent of surveyed manufacturers were using limited dashboards, and 53% were using embedded analytics within systems like CRM or ERP. Yet only three percent had any advanced analytics capabilities.

Though the shift from manual reporting to dashboards and embedded insights is promising, manufacturers are still only getting a handle on reporting. Where they fall behind is analyzing.

What is the gap in data analysis?

Reporting is easy with the right technology, but analysis is a strategic undertaking.

Though teams may use their CRM’s analytics to see what it says about opportunities, for example, these metrics are not tied to the rest of their sales data. Analysis is completely siloed rather than cross-functional across sales, engineering, or supply chain. And it’s not systematic.

This makes it nearly impossible to understand the “why” behind outcomes. Imagine in your CRM seeing that you have a 50% win rate for the same truck, at the same price point, across 10 customers. But why? Separate data on configuration will show that different customers have very different use cases—driven in snow versus desert conditions, for example. Getting data in a systematic way is the starting point to interpreting that data.

The next layer of data maturity: reactive to proactive

When you understand the “why” behind an outcome, you can proactively prevent or recreate that outcome. Now, you can use opportunity information to configure vehicle solutions that are optimized for customers in that snowy condition at the right price point. Or, you can tweak a product that’s not performing.

Reports are just a reactive snapshot. A descriptive analysis. Predictive and prescriptive analysis tells you what will happen and what to do about it, based on trends that are visible and the connections made across functions. Centralized data that makes it easy for each function to work from a single source of truth allows these predictive and prescriptive insights to surface.

Levers for achieving proactive and predictive analytics in industrial manufacturing

Two strategies, which are not exclusive to each other, can make data maturity acceleration easier than ever.

First, codifying end-to-end lifecycle data into a single platform or source of truth is essential. Sales data and configurations, engineering and product data, and fulfillment information embedded in a single platform, such as CPQ or a manufacturing lifecycle platform, makes cross-functional analysis possible.

It also sets the stage for AI, the second lever. AI can turn fragmented, unstructured (and structured) data, such as emails or BOMs or quotes, into structured and actionable insight. When different types of AI are combined, it can also validate this data to ensure accuracy and trust. Using AI, you can accelerate data maturity and scattered data to create structured data with guardrails.

Integrated data combined with generative AI capabilities takes manufacturers to that next layer. Then, when you make that data easy to access, share, and build in an embedded, intuitive system, decision making is sophisticated and proactive.

How Tacton brings it all together

Tacton helps manufacturers move from disjointed reporting to actionable insights by unlocking CPQ data in a single, intuitive platform.

With Tacton, you gain visibility into how products are configured, priced, and sold, helping you identify performance drivers, growth avenues, and bottlenecks.

In addition, AI capabilities ensure your teams are ready to move faster with your data.