The New Rules of Pricing Strategy in Complex B2B Manufacturing

Rising costs are forcing manufacturers to make tougher decisions about how they price. Materials, energy, and labor expenses continue to climb, with limited room to pass those increases on. And when pricing execution breaks down, it puts deals and margins at risk.

Rising costs are forcing manufacturers to make tougher decisions about how they price. Materials, energy, and labor expenses continue to climb, with limited room to pass those increases on. And when pricing execution breaks down, it puts deals and margins at risk.

A strong pricing strategy—how you set, adjust, and communicate your prices to customers—gives you control in an environment where very little feels predictable. By modernizing the pricing function and rewriting the rules on traditional pricing execution, you’ll deliver instant accuracy, reflect real value in every quote, and adapt pricing quickly as factors shift.

Modern pricing capabilities help manufacturers achieve ten percent more margin expansion

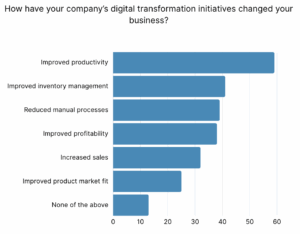

Manufacturers that invest in pricing as a core capability are strengthening margins and outpacing their competitors. Solutions like sophisticated pricing engines, solution-based pricing strategies, and deeper data visibility are putting early adopting companies ahead.

Boston Consulting Group reports that nearly half of “pricing innovators” in industrial goods have expanded their margins by more than 10 percentage points while simultaneously gaining market share.

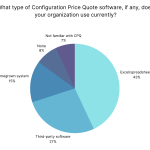

Yet most manufacturers struggle to keep pace, with our 2025 State of Manufacturing survey revealing that 49% face challenges with pricing adjustments and 43% still rely on Excel spreadsheets to price and quote complex products. A lack of agile pricing processes leads to errors, workarounds, and delays that put additional cost pressures on commercial functions.

But manufacturers can change the rules by rethinking how they conduct their pricing.

Rule 1: Go beyond cost—price with insight

Cost-plus pricing remains a useful foundation for many manufacturers. But in today’s market, where products are configured to order and margins are under pressure, cost alone doesn’t tell the whole story.

Leading manufacturers are enhancing their pricing strategies by factoring in customer impact, competitive alternatives, and commercial context. That doesn’t necessarily mean reinventing pricing from scratch. It means building on your cost model with insights that reflect what your offering helps the customer achieve.

For instance, if a particular machine configuration enables faster throughput or lowers operational costs, those benefits should inform how you frame and defend your pricing to avoid underpricing, protect profitability, and account for what your solution is worth in the customer’s world.

Rule 2: Disconnected CPQ processes no longer compete

In many organizations, configuration, pricing, and quoting (CPQ) are still handled in separate steps or manually across spreadsheets. This slows the sales process, creates inconsistencies, and often requires frequent collaboration between teams before a quote can be finalized.

Manufacturers are unifying these steps into one real-time, integrated process. As sales teams or customers configure a solution, the system automatically updates the price based on selected features, business rules, and customer-specific terms. Behind the scenes, real-time pricing pulls from integrated ERP, supply chain, and cost data to ensure every quote reflects current material prices, lead times, or delivery and installation costs.

If something changes, pricing adapts instantly, with no manual recalculations or delays. When a customer makes a configuration change, they should easily see not just the technical feasibility, but the financial impact.

Rule 3: Dynamic pricing models are essential for complex sales

Static pricing models cannot accommodate the complexity of today’s manufacturing sales. Leading companies are implementing multi-dimensional pricing frameworks that consider various parameters simultaneously:

- Product configuration specifics: Base pricing that adjusts automatically with each configuration choice

- Customer relationship factors: Different pricing tiers for new versus existing customers

- Segmentation: Different pricing or price sensitivity for customer segment and region

- Revenue model variations: Flexible structures incorporating one-time, recurring, and usage-based components

- Channel considerations: Adjusted pricing for direct sales versus partner channels

Each parameter becomes a lever for margin optimization. Instead of setting fixed prices or making after-the-fact discounts, sales teams should apply logic-based pricing models that adapt instantly within the appropriate guardrails.

Rule 4: Instant, transparent pricing is the new standard

Delayed pricing has become a competitive liability. Customers now expect immediate pricing feedback during the sales process, similar to their consumer buying experiences.

Leading manufacturers are implementing systems that deliver instant pricing calculations for even the most complex product configurations. This capability dramatically accelerates sales cycles and reduces the resource drain of manual pricing processes.

When sales teams can provide immediate pricing for any configuration scenario, they gain a significant advantage over competitors still relying on back-office calculations and delayed responses.

Rule 5: Margin protection requires end-to-end visibility

Many manufacturers quote based on production costs, separately pricing and quoting services, like maintenance or spare parts, rather than selling them as a full solution in one workflow. That approach can lead to margin surprises or erosion later in the deal cycle.

End-to-end visibility solves this by ensuring that pricing reflects the full cost to deliver the configured solution, from manufacturing and shipping to field service and ongoing support. As options are added or changed, total cost and profit margin are recalculated automatically, in real time.

This helps sales teams quote with greater confidence while protecting margin across the full lifecycle of the product and not just at the point of sale. Pricing isn’t managed in isolation. It’s connected, contextual, and controlled across the full solution, whether capital equipment, services, or spare parts.

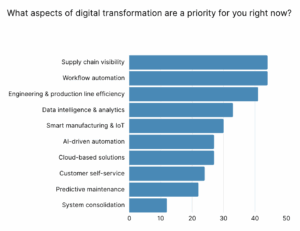

Rule 6: Data drives proactive pricing decisions

Leading manufacturers are using analytics to uncover where margin is lost, how pricing performs across products and markets, and where there’s room to optimize. When pricing data is connected to configuration, customer behavior, and cost inputs, it becomes a strategic asset.

With real-time analytics and reporting, pricing teams can:

- Identify unprofitable deal patterns before they happen.

- Monitor margin performance by product line, market, or sales channel.

- Simulate pricing impacts of changes in material costs or service models.

- Align pricing strategy with evolving market dynamics and customer needs.

Companies like Bromma are already taking advantage of sales data to improve profitability. By integrating CPQ, for example, with analytics platforms, they’ve moved from reactive pricing decisions to proactive, data-informed strategies that improve forecasting, product planning, and margin protection.

Assess your pricing strategy

Transforming your pricing approach doesn’t happen overnight, but even incremental improvements can deliver significant returns. Start by assessing your current pricing capabilities across these dimensions:

- How effectively does your pricing capture the value your solutions deliver?

- How tightly integrated are your configuration and pricing processes with your supply chain or inventory and other core systems?

- How quickly can you provide accurate pricing for complex configurations?

- How comprehensively do your price calculations account for all cost factors?

- How well do your pricing models adapt to different customer scenarios?

The answers will reveal your most promising opportunities for pricing transformation. Prioritize initiatives that directly address margin leakage and sales friction points, building toward a comprehensive approach that turns pricing from a necessary function into a strategic advantage.

Achieve dynamic pricing with Tacton

Tacton helps leading manufacturers protect margins, respond to rising costs, and deliver instant, accurate pricing across every product configuration. With powerful pricing capabilities built into the CPQ process, you gain full visibility, speed, and control.

With Tacton, you can:

- Replace spreadsheets and disconnected tools with a single system that ties product configuration directly to pricing logic.

- Adapt pricing instantly based on real-time product selections, customer terms, aftermarket service models, and region-specific variables.

- Reflect full cost-to-serve in your pricing, from manufacturing and shipping to installation and maintenance, so you quote with confidence and protect margin.

- Implement needs-based configuration to complement your pricing with the business outcomes your solutions deliver.

- Use analytics to track sales performance, forecast margins, and fine-tune your pricing strategy continuously.

Move beyond outdated pricing models and build a scalable, profitable approach to selling complex products. Learn more about our pricing capabilities.