6 Things Your ERP and CRM Can’t Tell You About Sales and Product Performance

ERP and CRM show what happened in your sales process, but configuration-level data from CPQ reveals why deals move or stall.

ERP and CRM systems provide critical operational and pipeline data, but they weren’t designed to capture configuration-level insights during the quoting process. For manufacturers selling highly configurable products, that gap leaves blind spots in sales performance, margin protection, and product portfolio decisions.

CRM shows pipeline activity, customer interactions, and win/loss outcomes. ERP connects finance, operations, and order data, revealing costs and margin after deals close.

But when manufacturers ask deeper questions, like ‘Why are some quotes converting faster?’ ‘Why is margin eroding despite pricing discipline?’ or ‘Why do certain products stall in the sales cycle?’ ERP and CRM alone can’t provide the answer.

CPQ captures configuration-level decisions made during quoting, providing a pathway to understand why deals move forward, stall, or erode margin. These decisions give manufacturers another layer of insight needed to make smarter business moves.

What is configuration-level data?

Configuration-level data captures every decision made during the Configure, Price, Quote (CPQ) process, including:

-

Selected and rejected options

-

Variant combinations explored

-

Revision counts

-

Pricing adjustments

-

Abandoned configurations

-

Time spent in each quoting stage

Unlike ERP and CRM data, configuration data reflects decision behavior before an order is finalized. When evaluating ERP, CRM, and CPQ within your overall tech stack, this is a critical difference: CPQ data helps you analyze configuration decisions associated with won deals, stalled deals, or reduced margin.

What are the limitations of ERP and CRM for sales and margin insights?

CPQ data adds another layer to your understanding of business performance.

| Data View | CRM | ERP | CPQ (Configuration/Quote Data) |

|---|---|---|---|

| Customer accounts and opportunity status | ✓ | X | ✓* |

| Pipeline value and forecasted revenue | ✓ | X | ✓* |

| Orders, fulfillment, and invoicing | X | ✓ | ✓* |

| Financial reporting and actual margin (system of record) | X | ✓ | X |

| Product configuration selections (options, variants) | X | X | ✓ |

| Variant and option selection frequency during quoting | X | X | ✓ |

| Configured products vs. products ultimately ordered | X | X | ✓* |

| Quote pricing and estimated margin during quoting | X | X | ✓* |

| Time between defined quoting lifecycle stages | X | X | ✓ |

| Quote revisions and workflow progression | X | X | ✓ |

| Channel-level quoting performance (direct vs self-service) | X | X | ✓ |

* Dependent on system integration and implementation setup.

6 things only configuration-level data can tell you

There are several questions that you can answer more easily when you have access to configuration-level data from your CPQ.

1. Why do certain product configurations close faster than others?

Consider a scenario where you want to understand which product choices actually help push deals forward, and why some quotes convert faster than others.

ERP shows what was ultimately ordered. CRM shows pipeline stages and win/loss outcomes. What they don’t reveal is what happened during the quoting process: which variants or components are most often involved in slower deals? Were certain options hard to evaluate or validate, requiring sales to manually continue the process outside of their CPQ tool?

Configuration-level data from CPQ can help you measure how long configurations remain in defined sales stages and which variants move from estimate to order more quickly. By comparing sales cycle duration and win rate across configurations, manufacturers can identify which product combinations consistently close faster.

2. How do specific product configurations impact margin?

It’s easy to link margin erosion to over-discounting or pricing changes. But even when sales teams follow pricing rules, margins can still decline.

The reason is that margin is typically reported after the deal closes, and data is aggregated at the order or opportunity level. That view hides what actually happened during configuration. It doesn’t show how specific options or variants change cost structures, trigger downstream complexity, or force concessions during quoting.

Manufacturers miss potential signals of margin erosion when they lack visibility into option-level tradeoffs. When margin is calculated in CPQ, you can surface average margin rate by configuration, territory, and attribute selection. With this information, you can identify which combinations consistently produce lower margin.

3. Which configurations increase the need for engineering support?

Why are orders that should have been “valid” still require engineering fixes?

Your CRM and ERP won’t show which individual rules, overrides, or combinations caused revisions. Meanwhile, your CPQ data shows early indicators of configurations that push feasibility limits and lead more often to engineering issues.

CPQ reveals configurations that experience longer sales cycle durations or lower win rates, giving engineering leaders visibility into where product complexity may be affecting commercial performance.

Now, your engineering team can analyze where products can be simplified or where additional guidance is needed.

4. Which product variants are rarely sold, and should they stay in your portfolio?

ERP reports show what ultimately sells, but they don’t show which variants are technically available yet rarely configured, or which options are frequently explored but consistently removed before a quote is finalized. That behavior signals hidden complexity and features that add decision overhead without driving demand.

Manufacturers struggle to rationalize their portfolios without visibility into how the full assortment is used during configuration. Configuration-level analysis exposes variants that are technically available but rarely or never sold. By comparing revenue, volume, and win rate across the full assortment, manufacturers can make informed decisions about which options to promote, adjust, or phase out.

5. How does product performance change based on configuration attributes or region?

Product performance is often analyzed by customer segment or region. While useful, those averages can hide meaningful differences in how specific configurations perform.

ERP and CRM data can show overall win rates or revenue by segment, but they don’t reveal how performance changes when a product is configured with specific attributes. When relevant conditions like application type, environment, or performance requirements are modeled as configuration attributes, CPQ analytics can measure how those selections impact win rate, revenue, margin, and sales velocity.

For example, a product with a 50% overall win rate may consistently achieve significantly higher win rates when paired with certain options or selected for a specific modeled use case or selected in a specific region.

Now, you can move beyond averages and understand where and why products perform best. In turn, this data informs more targeted guidance, positioning, and portfolio decisions.

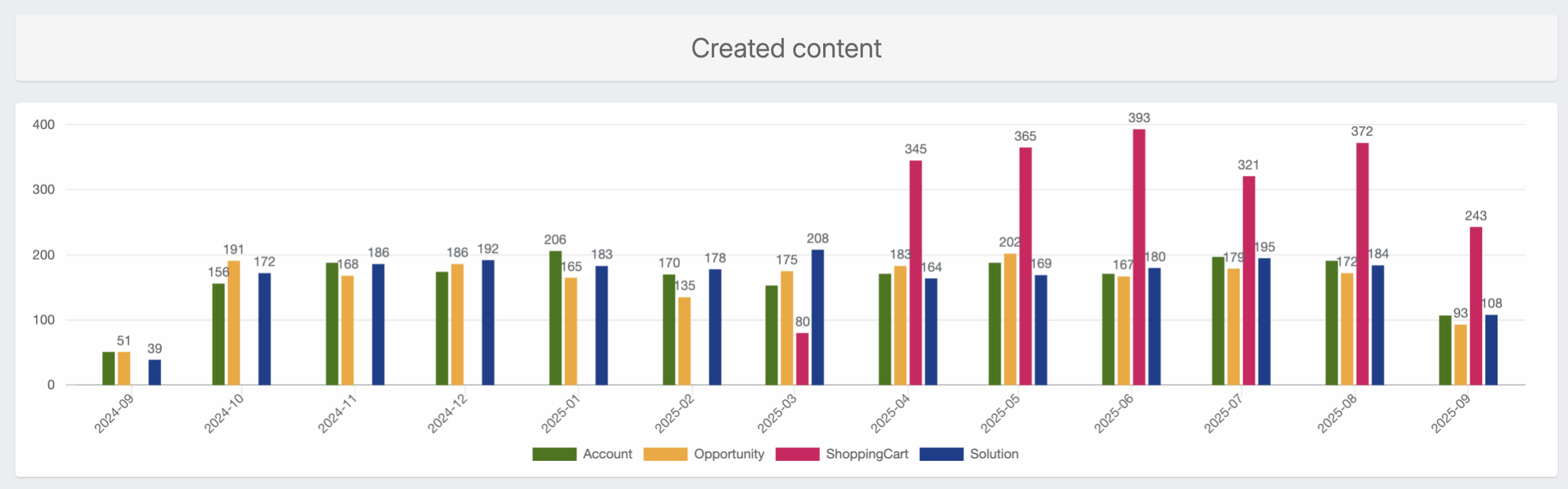

6. How can configuration data reveal emerging demand trends?

ERP and CRM data provide useful indicators of future demand based on past orders and deal outcomes across products and segments.

Those signals, however, only appear once demand is already established. They don’t help teams spot emerging opportunities or adjust strategy before patterns show up in historical data.

Decision-level insights at the time of configuration tell an additional story. By analyzing how many opportunities include specific configurations in early sales stages, and combining that with historical time-to-order data, manufacturers gain forward visibility into potential product demand before orders are finalized. That early signal of interest helps you identify growing demand for specific solutions sooner and adjust guidance, positioning, or portfolio decisions.

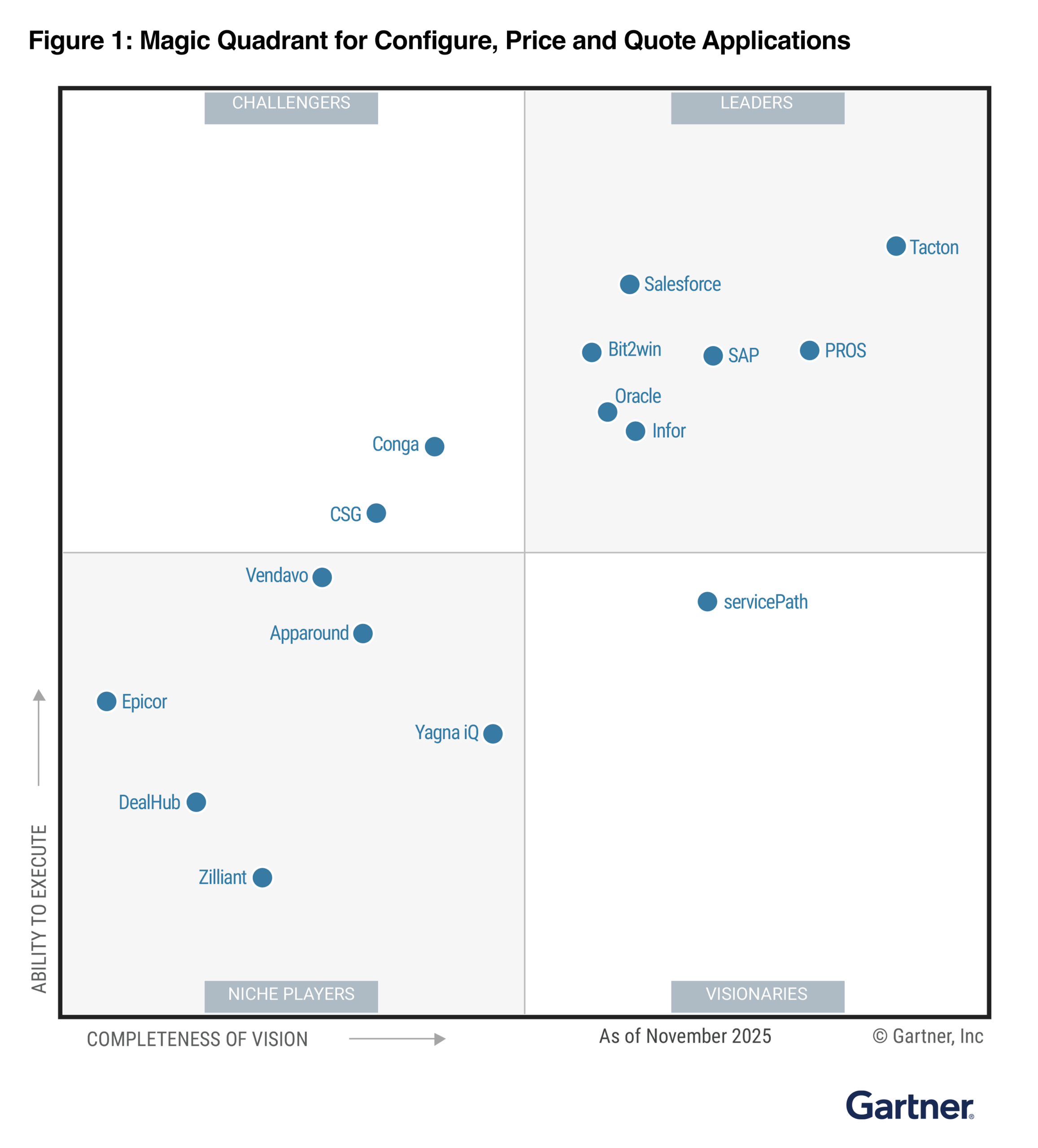

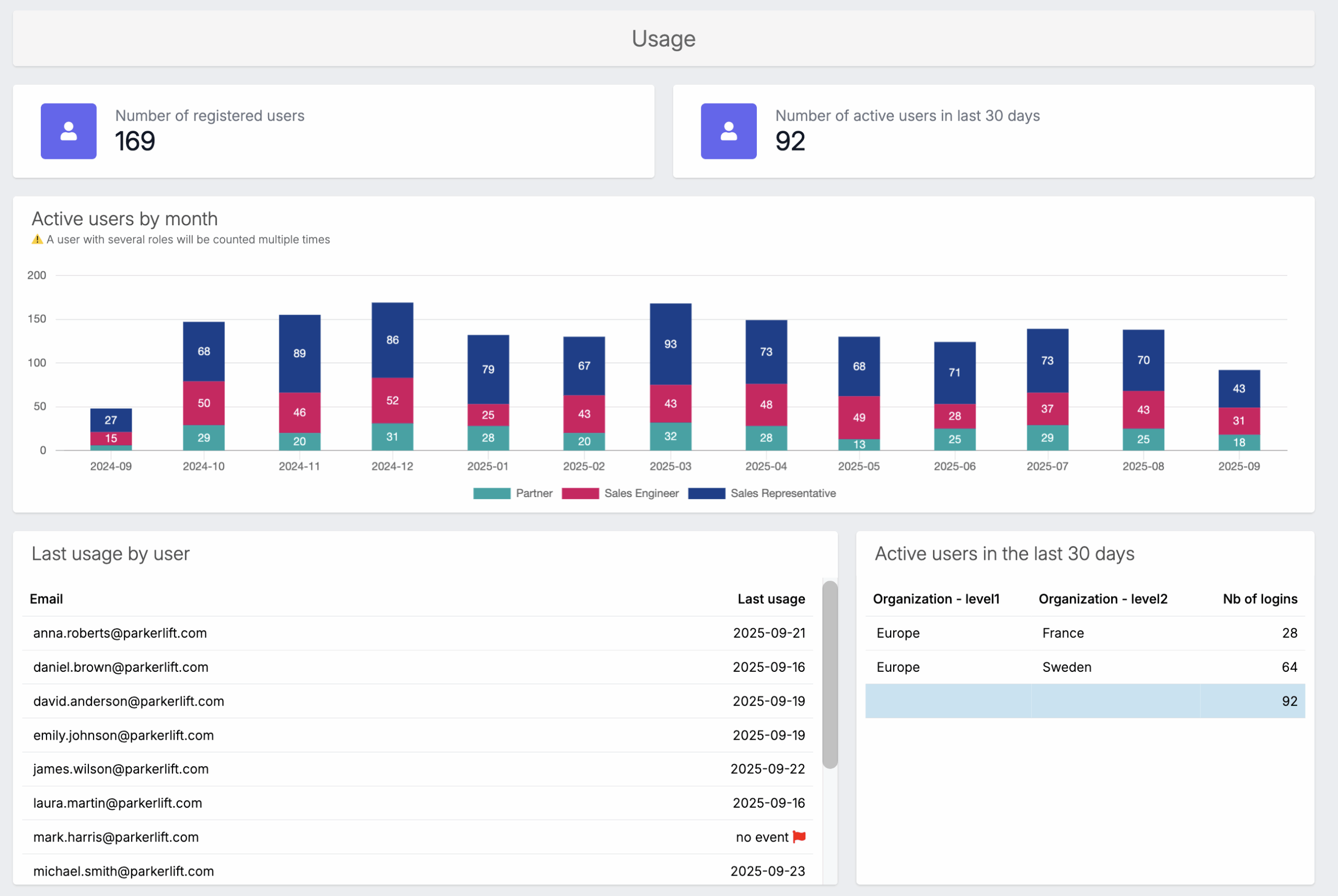

Connect the dots across your data with Tacton

ERP and CRM will always be essential to understanding business performance, but they weren’t designed to explain how customer decisions and business requirements impact sales, margin, and product.

Tacton CPQ allows manufacturers to visualize configuration and quote data directly in the platform, without the need for IT support or technical enterprise BI tools. With Insights & Analytics, you can quickly and easily see how quoting and configuration-level decisions influence business outcomes, so you can make portfolio and sales decisions that reflect what customers really want or need.