How to Implement Self-Service Analytics in Manufacturing for Non-Technical Teams

Manufacturers are sitting on powerful data locked behind BI tools and IT requests. Learn how to amplify self-service analytics to accelerate smarter, data-driven decisions across the manufacturing lifecycle.

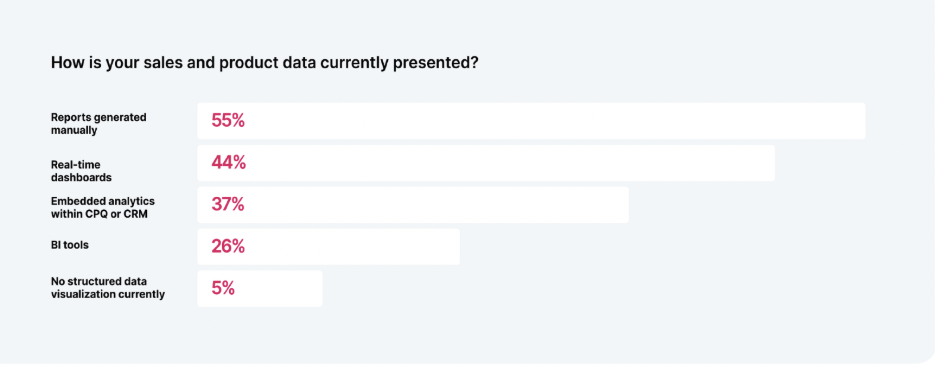

Acting on the abundant data manufacturers have, whether it’s win-loss data, product performance, or price sensitivity, is difficult when most users are not data scientists.

Traditional BI tools and manual data analysis require technical consultants and IT dependencies, which places knowledge gaps firmly between your teams and faster opportunity creation. It also increases the workload for IT departments who field frequent requests to pull data.

While BI tools and analytics APIs still hold their place, self-service analytics for manufacturing is now an essential avenue for IT teams to respond dynamically to the market. IT must invest in self-service analytics tools built for real users, and Configure, Price, Quote (CPQ) is an effective place to start, as it sits at the intersection of product and engineering, pricing, and sales. And next generation analytics tools are connecting easily accessible data across the entire manufacturing lifecycle.

Why embedded, use-case specific analytics tools accelerate insights

Traditional BI tools require specialized skills in data modeling and maintenance. And while APIs provide flexibility, they often return raw, low-level data that non-technical users struggle to interpret.

Modern self-service analytics embed data dashboards and visualization directly into the systems that your sales, engineering, or product teams use every day. They scale data access and also decouple data for specific use cases. For example, a self-service analytics tool may have specific use cases that analyze and drill down on product portfolio performance or order fulfillment activity.

Why is this so important?

Generalized data through APIs can be helpful for higher-level, technical analysis, but the benefit of use case-specific self-service analytics tools are two-fold.

- For teams, they focus the data in a way that makes it easy to manage and retrieve based on user roles and what’s most relevant to them.

- For IT teams, these system-embedded analytics tools (e.g., analytics embedded in CPQ) can optimize the specific data feed or source as well as the analytics tool itself, making the data analysis much richer. And with data coming directly from the system, you already have a data lake to work from without the need for consistent uploads.

Instead of forcing IT to build and maintain dashboards from scratch, embedded and use-case-specific analytics bring structured, ready-to-use insights directly into the tools business teams already use. IT can still maintain control and governance while equipping non-technical business users to explore trusted data independently.

The new generation of self-service analytics tools

Self-service analytics refers to simplified, embedded, or low-code tools that allow non-technical users to visualize and act on data. They eliminate pesky dependencies and the need to create completely new tools.

What makes the new generation different?

- New generation tools are built around pre-modeled data sets designed for specific manufacturing processes like quoting, configuration, and product performance. They offer no-code customization and easy shareability amongst and across manufacturing teams and functions.

- They combine data preparation, visualization, and export tools into a single, governed environment, so there is no need for separate BI licenses or external consultants.

- They offer extensibility (i.e., introducing additional external data) for IT through clean APIs and customizable data models.

Self-service analytics vs. BI tools: finding the right balance

It’s not necessary to choose entirely between one or the other, but often, there is a pushback when upsetting the current processes for analyzing data.

“We already have BI tools. What makes this more insightful?”

“We need flexibility and data control.”

“APIs give us more freedom.”

The answer is to keep them. Self-service analytics complements traditional BI by handling everyday operational insights directly within business tools. IT still has full oversight of data sources, permissions, and scalability while reducing manual requests. And, users will receive data that’s governed and contextualized, while IT can still manipulate raw data as needed.

With the right balance, IT can focus on data strategy and governance (not dashboard maintenance) and empower business users to make faster decisions with only the most relevant data they need.

What manufacturing teams can achieve today with self-service data analytics

Using self-service analytics, your teams can start acting on data today to improve profitability, growth, and ROI for the company.

Sales & Commercial Teams:

- Identify which configurations, channels, or regions drive the highest margins.

- Track quoting velocity and conversion to improve forecasting accuracy.

- Compare adoption and performance across direct and partner channels.

Product & Engineering Teams:

- Analyze which features or configurations correlate with higher win rates.

- Spot over-engineered or underperforming product variants to streamline design.

- Detect trends that guide smarter assortment and pricing strategies.

IT & System Administrators:

- Monitor user adoption, data quality, and engagement without building reports.

- Maintain centralized control of data governance while reducing recurring support requests.

- Extend data access through APIs when deeper enterprise integrations are required.

These insights can happen in minutes, rather than weeks. For IT leaders and CIOs, their departments can focus on building a data-driven organization where teams understand performance metrics and align across functions. This pushes organizations toward greater data maturity, where there is a single source of truth and cross-functional data sharing that takes the organization from reporting to analysis.

For example, a regional sales director compares recent quoting data and sees that configurations including optional service packages consistently deliver higher margins and faster approvals. Within minutes, she shares this insight with other teams, prompting sales reps to highlight those packages earlier in the sales cycle. It’s a small change that boosts average deal size without adding IT workload or waiting weeks for a BI report.

The next step: bringing analytics closer to the source

As manufacturers look to extend digital transformation beyond engineering and production, CPQ is becoming a natural starting point for data-driven insights. Embedding analytics directly into quoting and configuration processes allows every team—from sales to engineering—to act on trusted, contextual data in real time.

At Tacton, we’re focused on helping manufacturers connect the dots between product, customer, and performance data. Want to see how analytics within CPQ can unlock faster, smarter decisions across your organization?