Blog

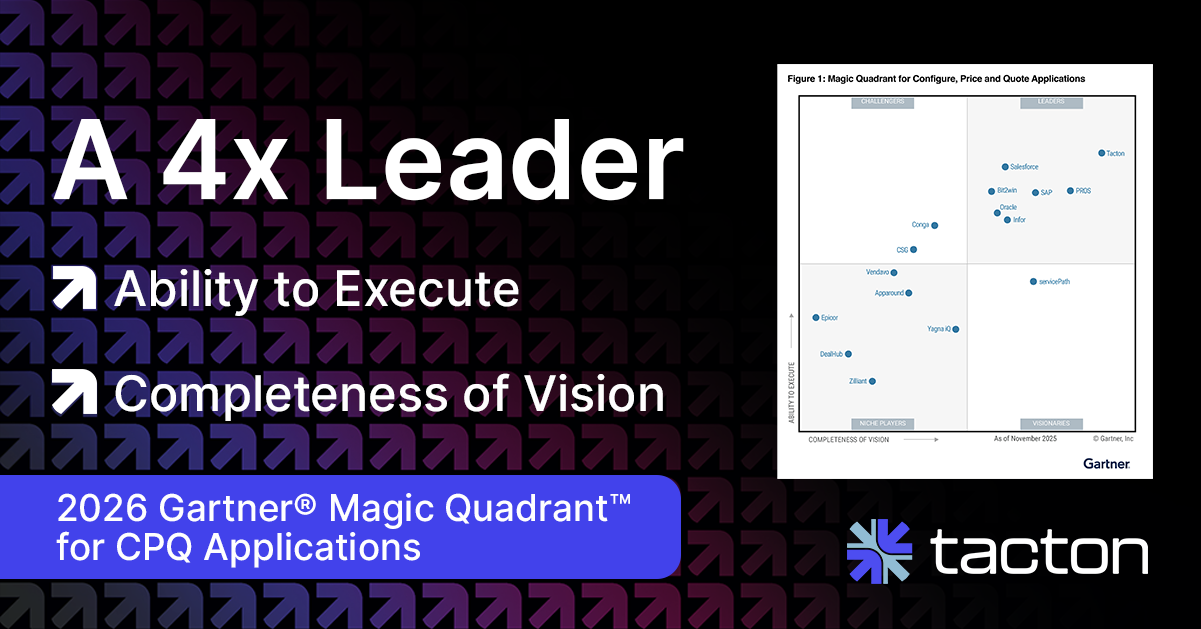

Tacton Named a Four-Time Leader in the Gartner® Magic Quadrant™ for CPQ Applications

Tacton’s perspective on the 2026 Gartner® Magic Quadrant™ for CPQ Applications.

Enterprise CPQ for Complex Manufacturing: What It Takes to Scale Successfully

Enterprise CPQ goes beyond faster quotes. Build a scalable operating model that supports growth across your business.

Generative AI Best Practices in Manufacturing: The Dos & Don’ts for Smarter Quote-to-Order

Manufacturers are eager to adopt generative AI, but many still struggle with trust, risk, and realistic expectations. These practical guidelines help manufacturers avoid risk and set realistic expectations.

How to Respond to Manufacturing RFQs Faster with AI Sales Assistance

RFQ response time is now a competitive differentiator for customers who expect a fast and seamless buying experience. AI sales assistance can transform how manufacturers respond to high RFP volume.

The Digital Thread in Manufacturing: Connecting Data Earlier Across the Lifecycle

By connecting customer intent and configuration data early to the product lifecycle, manufacturers extend the digital thread across sales, engineering, and production.

How Tacton’s 3D Product Configurator Solves These Manufacturing Sales Challenges

A 3D product configurator gives manufacturers a faster, more accurate, and more intuitive way to sell complex products by dynamically visualizing every configuration. Learn how Tacton's visualization capabilities embedded in CPQ accelerate your sales.

5 Benefits of Configure-to-Order Manufacturing and When to Adapt to CTO

Learn how configure-to-order (CTO) solutions help manufacturers deliver customized products faster and how it differs from engineer-to-order.

Tacton Behavior & Engagement Analytics: Unlock CPQ ROI and Better Sales Performance

Strong CPQ adoption drives real ROI. Tacton Behavior & Engagement Analytics provides CPQ usage dashboards directly in the platform to track user behavior and uncover opportunities to improve performance.

Bill of Materials (BOM): What It Is and How to Automate in Manufacturing

A Bill of Materials (BOM) is the foundation of every product you build. Learn how automation helps keep sales, engineering, and production aligned in manufacturing.

Tacton Insights & Analytics: Self-Service CPQ Analytics for Manufacturers

Tacton Insights & Analytics brings powerful, easy-to-use analytics directly into Tacton CPQ.

How to Implement Self-Service Analytics in Manufacturing for Non-Technical Teams

Manufacturers are sitting on powerful data locked behind BI tools and IT requests. Learn how to amplify self-service analytics to accelerate smarter, data-driven decisions across the manufacturing lifecycle.

Symbolic AI in Manufacturing: The Key to Accuracy and Efficiency

Using rule-based logic instead of pattern-based guesses, symbolic AI ensures every product configuration is valid and manufacturable, so your business can quote faster, accurately, and profitably.