6 Manufacturing Trends in 2025 to Watch

Tacton's 2025 State of Manufacturing survey reveals six industry trends in strategic initiatives, digital transformation, AI and more.

Our annual State of Manufacturing survey reveals manufacturers are charging ahead with transformation in 2025, but not always in the same direction. The survey of over 200 global industrial leaders uncovered rising tensions shaping the year’s biggest shifts: manual vs. digital, efficiency vs. experience, resilience vs. innovation.

While some companies are making bold moves with AI and automation, others are still held back by manual sales processes, fragmented data, and knowledge loss. These 2025 manufacturing trends show the urgency, uneven progress, and growing pressure to connect operations and customer engagement into a single, scalable strategy.

1. Manual Sales Processes Are Becoming a Competitive Risk

In favor of transformation on the production floor, manufacturers remain stagnant on digital sale transformation in 2025.

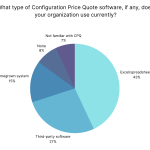

Despite widespread digital transformation efforts, 43% of manufacturers still configure, price, and quote customer solutions using manual, Excel-based processes. Furthermore, 62% of survey respondents still rely on manual consultation to guide solutions, and nearly half of manufacturers report still using static product catalogs to guide conversations.

This signals more than just an inefficiency issue. Manual processes limit the ability to tailor conversations to customer needs in real time. When sales teams rely on static tools, inconsistent logic, or engineering back-and-forth to deliver a proposed solution, they lose the ability to confidently guide buyers, explore tradeoffs, or pivot to value.

According to research by Forrester, 86% of B2B purchases stall during the buying process and 81% of buyers express dissatisfaction with the vendors they choose. Buyers indicate that while digital, self-service experiences are desirable, when speaking with a sales representative, they want someone who understands and is responsive to their needs and goals.

As product portfolios become more complex and buying expectations shift toward speed and autonomy, the gap between manual processes and modern sales models will continue to widen. Manufacturers that fail to digitize their sales processes risk losing ground in both efficiency and buyer trust.

2. Supply Chain Visibility Continues to Be a Top Internal Priority

Manufacturers have learned the hard way that volatility, shortages, and delays can undo even the most sophisticated engineering or sales strategies. That’s why supply chain remains the heartbeat of transformation efforts in 2025:

-

66% of manufacturers rank it as their top investment priority during economic uncertainty

-

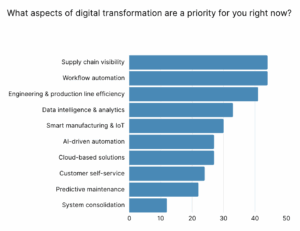

44% list supply chain visibility among their most critical digital transformation goals alongside workflow automation and production line efficiency

But while internal supply chain visibility is improving, there’s little indication this data is flowing into customer-facing processes like quoting, lead-time accuracy, or the customer experience.

It’s a missed opportunity. For many, the quoting process still operates in isolation, without immediate visibility into inventory constraints, production timelines, or part availability, and vice versa. Manufacturers have the opportunity to use configure, price, quote (CPQ) data, for example, to forecast demand and make supply chain data accessible, relevant, and actionable in the sales process to improve the customer experience at all points in the buying journey.

3. Mid-Market Manufacturers Are Gaining Momentum in Advanced Technology and AI

Manufacturers in the $500M–$999M revenue range are showing strong momentum in AI adoption—22% report already investing heavily in AI, more than double the rate of their enterprise peers with over $5B in revenue (just 10%). They’re also exploring AI uses cases at the same rate as larger companies. While larger companies ($1B–$5B) lead in overall AI investment levels, it’s these mid-sized firms that are showing increasing focus in digital maturity. They’re prioritizing AI-driven automation (51% vs 10% of large enterprises), cloud solutions (49%), and data analytics (46%) at higher rates than their enterprise counterparts, suggesting a strategic focus on agility and practical outcomes over complexity.

The future of manufacturing innovation won’t be shaped solely by size, but by speed and adaptability. As firms from $100M to $1B scale their AI capabilities, they’re becoming the real-world test beds for what smart manufacturing can deliver.

4. Current Solutions to Workforce Transitions Are Threatening Scalability

While many manufacturers continue to invest in automating production and managing supply chain risk, a growing challenge is emerging within their commercial and engineering teams: knowledge loss and workforce transition.

According to our survey, 30% of manufacturers expect at least 16% of their sales and engineering workforce to retire within the next five years. Yet fewer than half feel fully prepared to manage that transition. Most are responding through mentorship programs (52%), structured training (46%), or proactive recruiting (39%), while only 32% are digitizing internal product or sales knowledge.

At the same time, onboarding is at risk of slowing down as companies try to expand their product portfolios or enter new markets.

Manufacturers are still relying on human-to-human transfer of knowledge to sell and quote complex products. That model isn’t scalable, and it’s especially risky in a tight labor market or during generational turnover.

If institutional knowledge continues to live only in the heads of a few experienced sellers and engineers, organizations will face slower time to revenue, inconsistent buyer experiences, and increased quoting risk. The manufacturers that succeed will be those who embed expertise into systems, not just people.

5. Operational Gains Are Outpacing Customer Engagement Improvements.

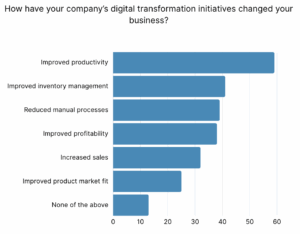

Digital transformation is delivering results in production and fulfillment. According to the survey, 52% of manufacturers are focused on warehouse management, 41% on inventory visibility, and 44% on workflow automation. Many report real improvements: 59% cite increased productivity, 41% improved inventory management, and 39% reduced manual processes as direct outcomes of their transformation efforts.

These backend gains are beginning to improve fulfillment timelines, order accuracy, and supply chain coordination. But the front of the customer journey tells a different story, with sales gains trailing behind.

Sales transformation efforts are losing momentum, falling from 68% in 2022 to just 52% in 2025. Self-service configuration, guided selling, and personalized buying experiences remain underdeveloped, even as quote volumes and complexity rise.

Manufacturers are starting to deliver value faster at the end of the process, but to compete, they’ll need to do the same at the beginning. As B2B buyers expect more from their first interaction, it’s not enough to fulfill quickly. Manufacturers that extend transformation to the front of the sales cycle will be better positioned to connect operational efficiency with commercial impact and build loyalty from the first touchpoint.

6. Digital Strategy Is Accelerated by Competition

Manufacturers aren’t just planning transformation, they’re actively searching for it.

Across every channel—whether it’s reading trade publications, attending events, calling vendors, or benchmarking competitors—engagement with new digital technology solutions is up from 2023 to 2025, according to the survey. Compared to 2023, more manufacturers are looking for tech solutions by:

- Attending industry events and conferences (up 8% in 2025)

- Reviewing trade publications and industry reports (up 17% in 2025)

- Hiring technology advisors (up 14% in 2025)

- Engaging with peers and partners for recommendations

At the same time, competitive pressure was named as the second greatest transformation driver, surpassing economic uncertainty, energy costs, or even customer expectations.

Transformation is no longer a back-office planning exercise but a visible, competitive race. The urgency is higher, the market signals are louder, and digital solution evaluation is happening in more places than before.

Understanding the Bigger Picture of Manufacturing in 2025

These trends reflect deeper shifts in how manufacturers are approaching complexity, competitiveness, and transformation in 2025. From the persistence of manual processes to the rise of AI in mid-market innovation, each trend points to the growing need for more connected, scalable, and customer-aligned ways of working.

For a deeper look at the data behind these insights, download our full 2025 State of Manufacturing report. The survey, conducted by Tacton and Researchscape, reveals how over 200 global manufacturers are navigating digital transformation and AI, economic uncertainty, go-to-market agility, and workforce shifts.

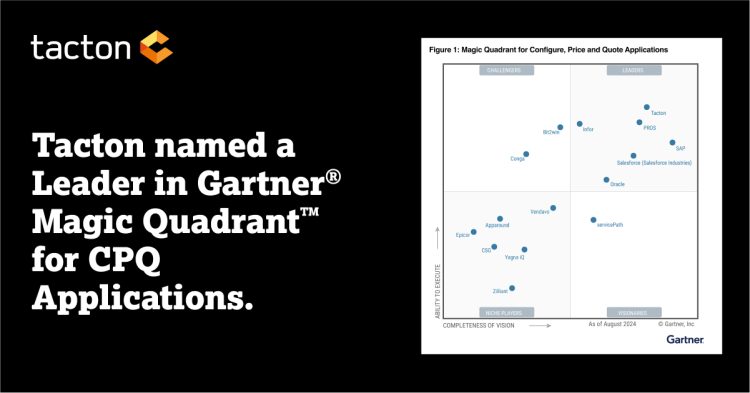

And if your business is looking to bring these strategies to life, whether it’s digitizing your sales cycle, embedding product intelligence into quoting, or scaling expertise across teams, Tacton is here to help. Our CPQ buyer engagement platform is built to simplify complexity and accelerate your go-to-market strategy.